Horizon 2: Launching UBS SmartWealth

Igniting in-house innovation

Launching SmartWealth, a breakthrough robo-advisor product that democratised UBS’s services to a mass-affluent audience.

How do you democratise 150 years of premium Swiss banking heritage?

UBS challenged us with a smart idea. Together, we launched a wealth ‘robo-advisor’ for the masses in 18 months — from innovation to in-market MVP.

From innovation pilot to market launch

Idea to proof-of-concept in 90 days

Secured funding for beta launch in eight months

From beta to market launch and Golden Circle Awards winner

From high net worth to a brand new audience

Wealth management services for high-net-worth people require deep investment expertise. That same insight could support ‘mass affluent’ groups, but could high-level service be widely extended without in-person expertise? Digital opened an exciting door for UBS, and the market response had to be fast.

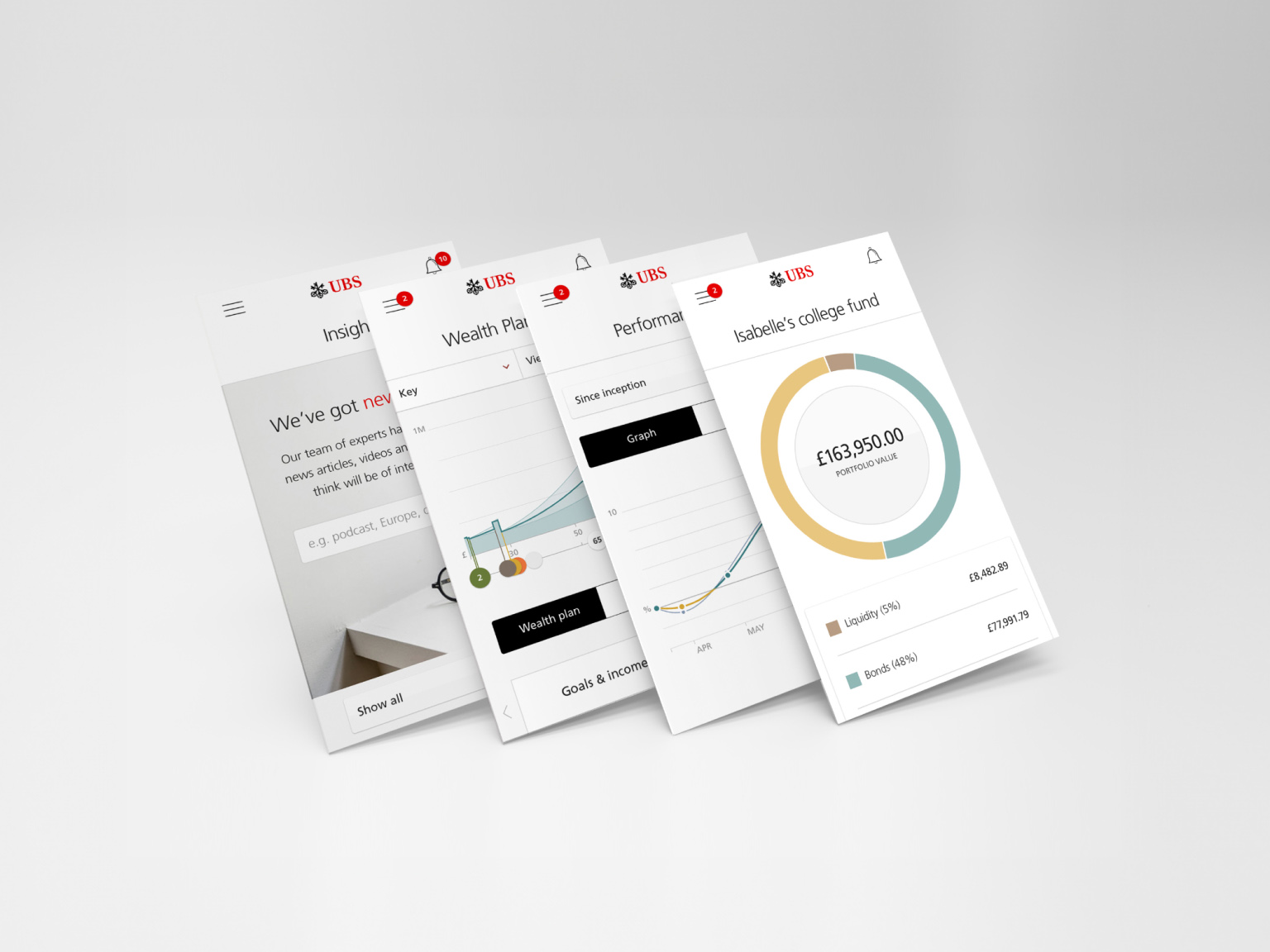

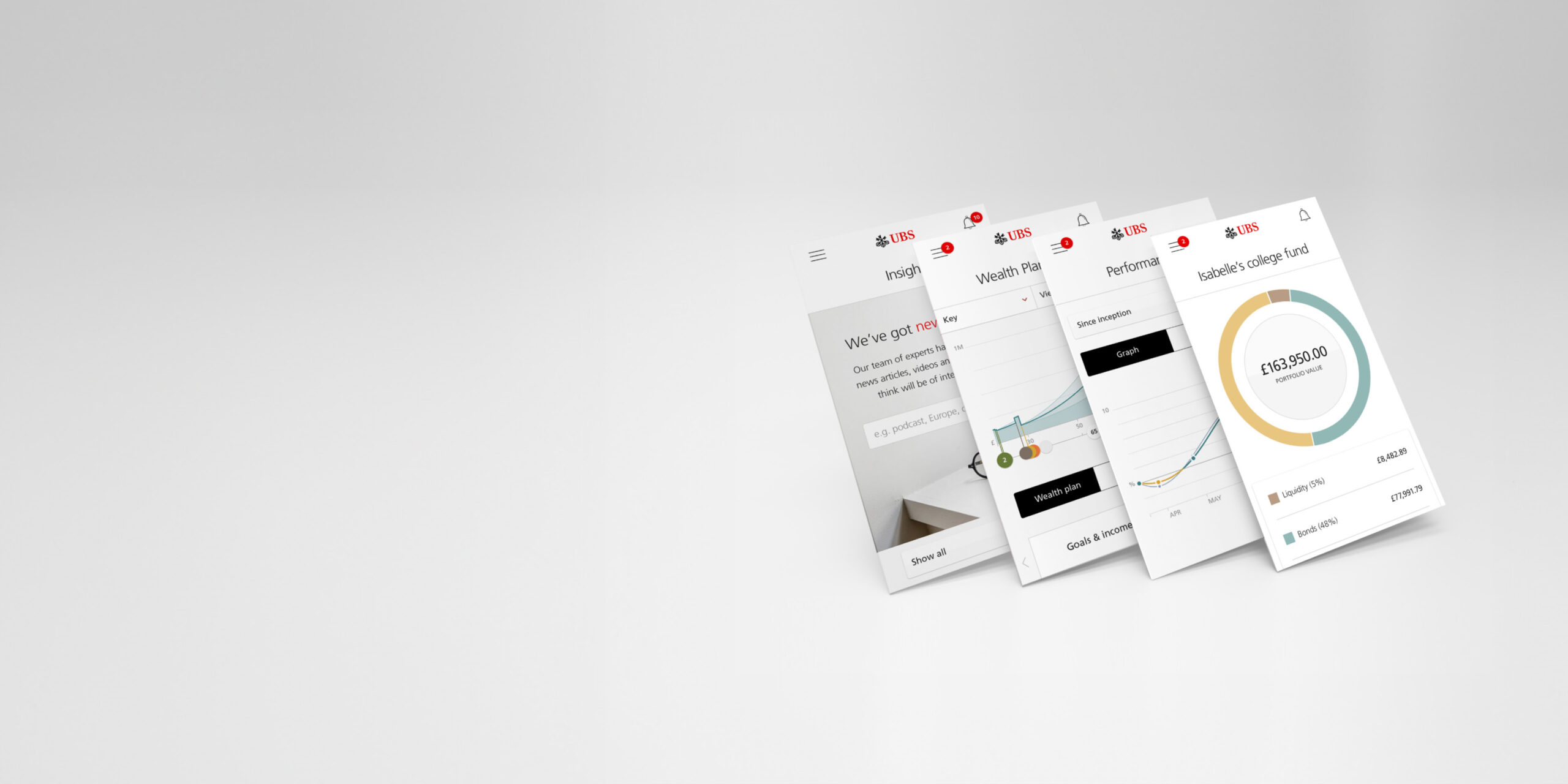

We designed a platform to take UBS wealth management expertise to those with £15K investible. SmartWealth offered personalised wealth management optimised across desktop, tablet and mobile. It captured the imagination of mass affluent investors, industry and media.

Building UBS SmartWealth for launch was probably the most exciting period of my working life. The way the team worked was revolutionary. The delivery of SmartWealth was a real moment of change for UBS.

Nick Middleton, Former Head of UBS SmartWealth

Making the intangible, tangible

The instant innovation lab

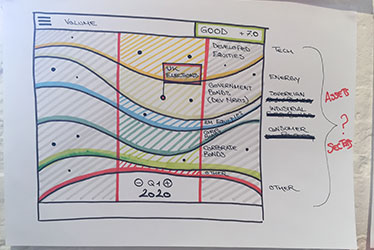

40+ UBS stakeholders joined our studio to co-design a proof of concept in 90 days. Through collaborative visualisation and prototypes, the UBS innovation team secured beta launch funding. Immersive collaboration became the hallmark of SmartWealth’s success: later, we spent six months embedded in a new UBS startup to define the product.

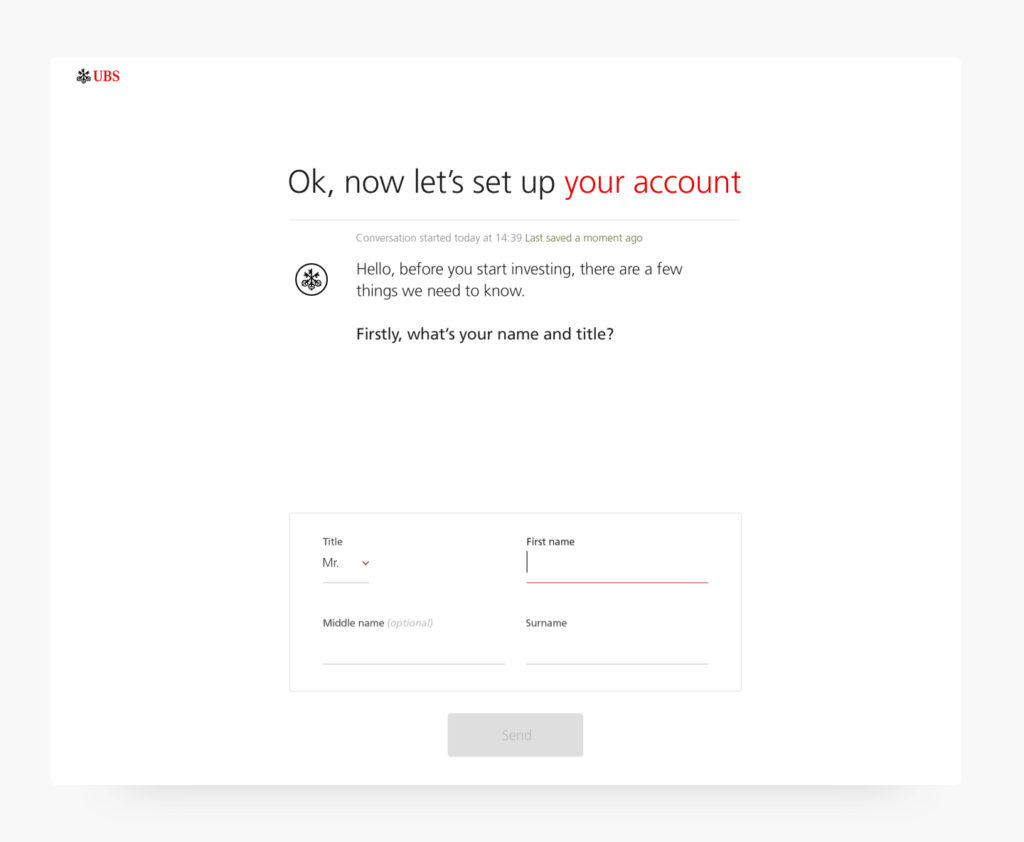

Empathetic experience design

Financial applications can often have long and involved on-boarding processes. SmartWealth introduces a chat style interface to engage new clients around this process while making the steps as short as possible.

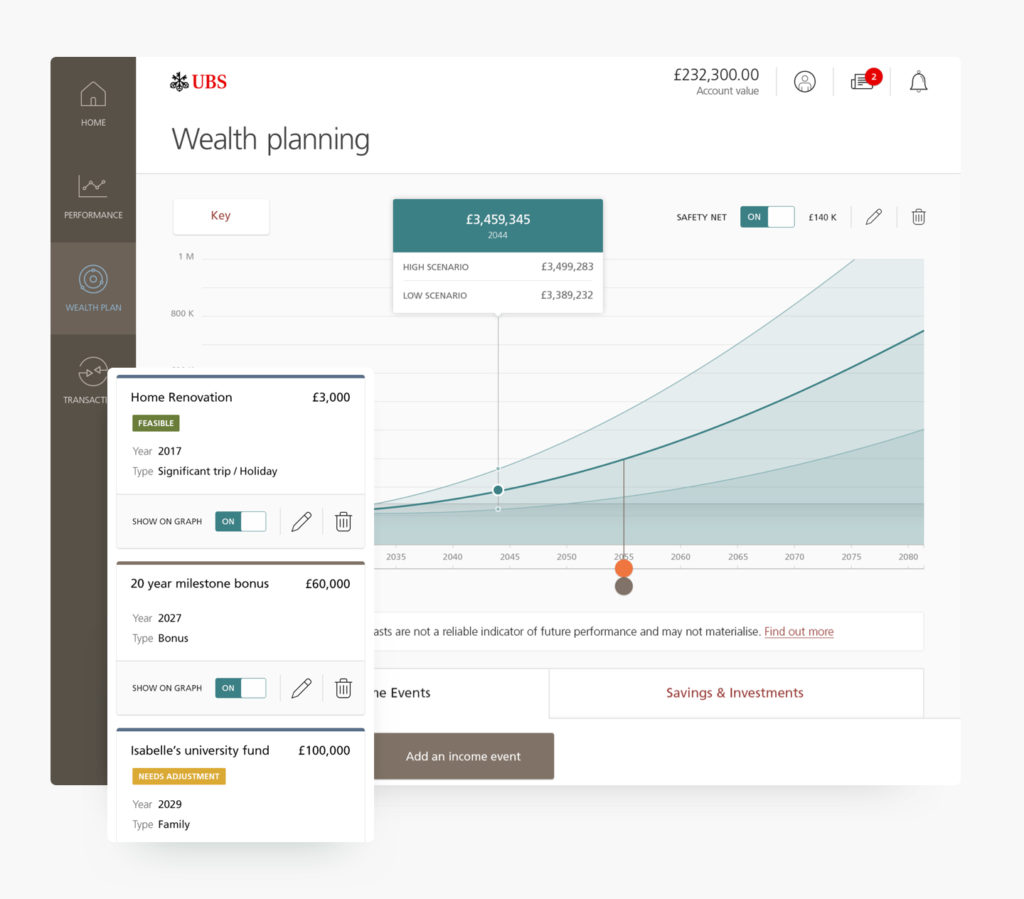

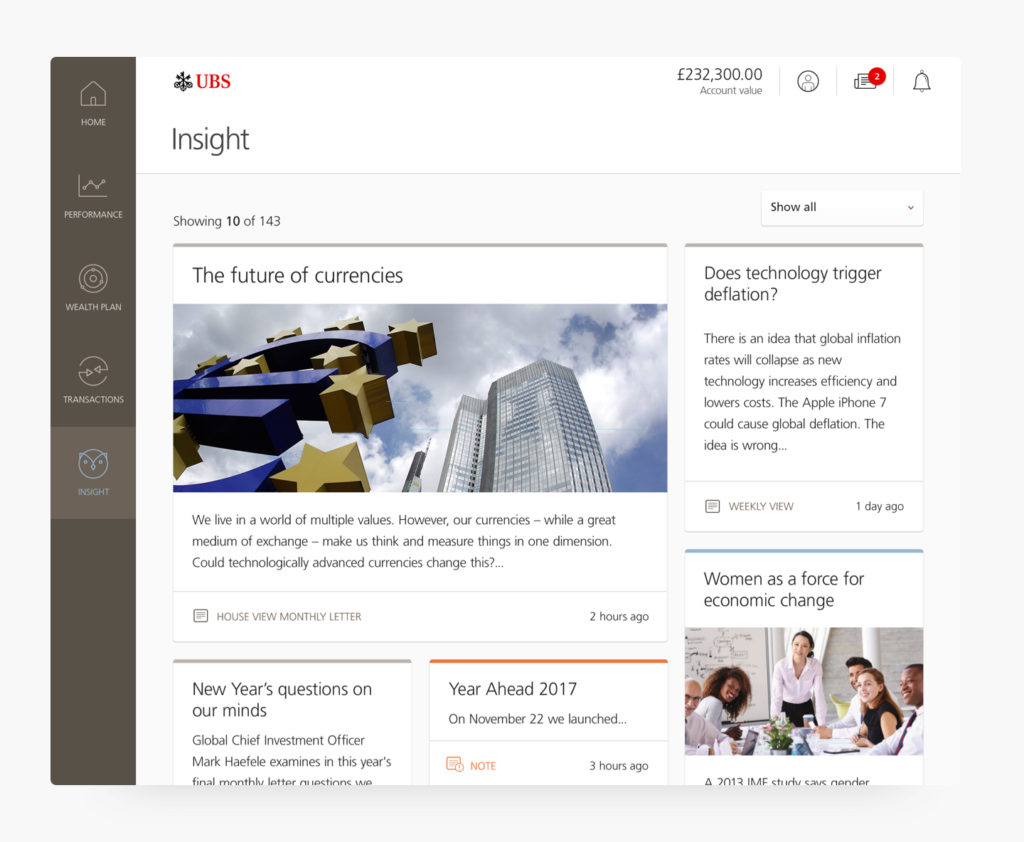

Wealth Planning is the backbone of SmartWealth It encourages people to take responsibility for their wealth by enabling them to visualise their wealth against life goals.

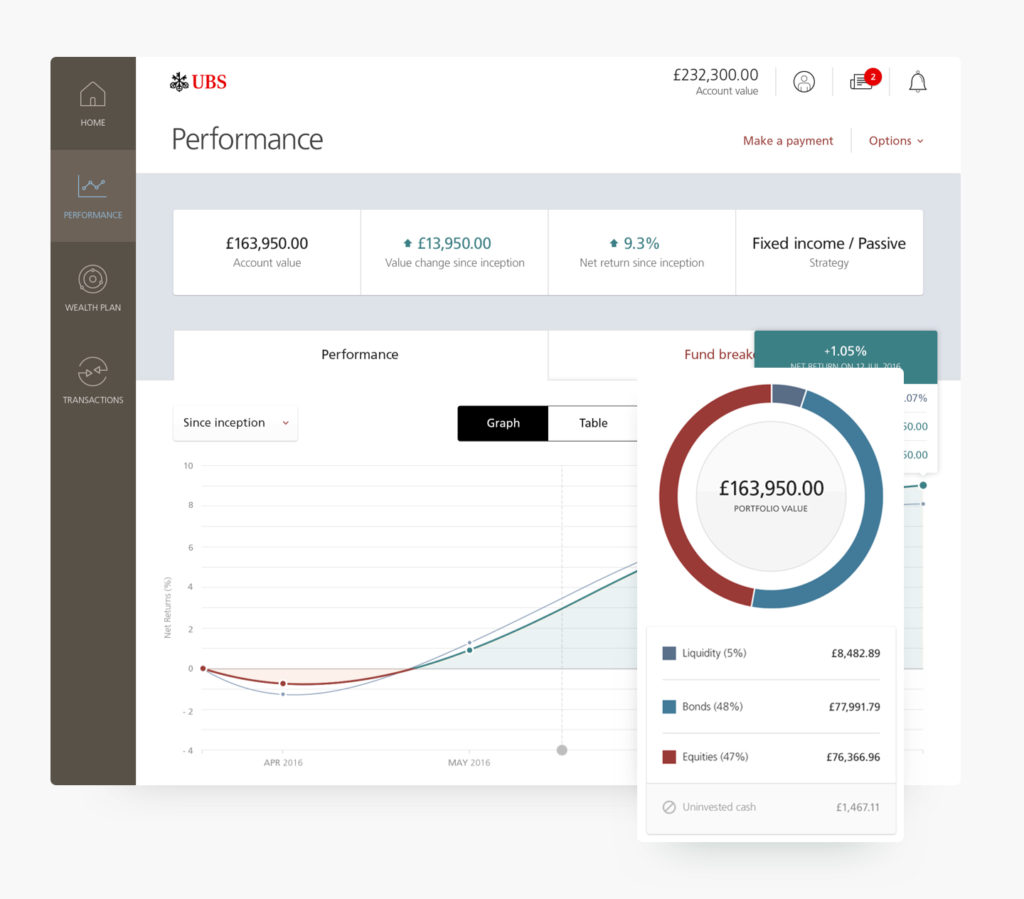

Portfolio performance encourages clients to view their investment over a long term view. Individual portfolio’s can be interrogated around each asset class and its contribution to overall performance.

SmartWealth leverages UBS’s CIO (Chief Information Office) content to build an understanding of how market events could affect a client’s portfolio and what action UBS are taking as a result.

Else helped take us from complex ideas and problems to a living, breathing product that will make a positive, meaningful impact on people’s lives.

Shane Williams, Former Co-Head of UBS SmartWealth

Impact

We revolutionised ways of working at UBS Wealth Management through close collaboration. It sparked a cultural shift and a new wave of in-house entrepreneurs.

- UBS SmartWealth launched successfully in less than 18 months

- In partnership, we proved the case for a new kind of investing service

- We revolutionised UBS teamwork and product development

- Revealing 60+ opportunities on the customer journey

- Unlocked: commercial value and entrepreneurial talent for the world’s largest wealth management brand

- Winner: Technology Innovation of the Year, 2017, Magic Circle Awards

Change starts with a conversation