Future of finance

Part 2

Challenger banks are here to stay. Customer adoption is clear, with a few already becoming household names, placing them firmly in the mainstream. The high-street incumbents, initially caught napping, have been ramping up their efforts to catch-up. However, it feels today there’s a lot of looking over the shoulder at the competition, resulting in most retail banking products gravitating around a common feature set. So what does it mean if you plan to challenge a challenger bank today?

In part one we covered how banking products are still designed as one-size-fits-all – regardless of the recent innovations from challenger banks. Yet people’s lives are in constant flux, their financial needs continue to evolve and most people not only struggle with the big financial decisions, but also underestimate the financial cost of not making a decision. Offering solutions that aren’t just designed for the masses, or Mrs. or Mr. Average, is a step towards solving people’s ever-changing needs – who wouldn’t like a service that could grow with you? Offering relevant support, help and products that encourage an increase in financial literacy, not only your bank balance. You can read the first article here.

In part 2, we’re going to look at another underserved area of high street finance – shared finance – and why it will become increasingly relevant in the future of retail banking.

No-one transacts alone…

Fundamentally money is an exchange of value for goods or services in a transaction. And transactions, importantly, do not happen alone they always happen between people, often, with one half of the transaction carried out on behalf of a group. This might sound obvious, so why do most retail financial products seem to be designed with one person in mind, using money in isolation.

Think about how you used money in the last month and you’ll quickly see how intertwined other people and groups are within your transactions. From chipping in to buy a friend’s present, or bill splitting for a weekend away, through to paying shared rent or a joint mortgage – it’s revealing to see many transactions happen as part of a group rather than as a sole entity.

Even though we transact daily, and are very comfortable transacting in groups, there are a few key points any shared financial product needs to address to be successful. The main one? Trust. Whenever you’re adding an extra party into a transaction or the ownership of money, trust needs to increase.

Trust in transactions

An integral part of trust are successful payments – at a basic level, we all have experienced paying for something as a group. Some people pay straight away, whilst others seem to like to keep hold of their cash as long as possible. Added to that is the large topic of the legalities of joint ownership. Outside of these key considerations, looking into the design of the products, there’s a limited number of decent products that truly cater for shared finance. Many are not fit for this purpose, with painful Know Your Customer (KYC) processes, that the public has just taken as the cost of doing business with banks.

The design for shared financial products will become increasingly important for the future of retail banking as the usage of cash diminishes [In the last 10 years the use of cash in transactions has gone down from 60% to 30% – Forbes]. There’s a clear opportunity for products to cater for, and even own, shared finance.

How joined up is a joint account

The trusty joint account. Really, it’s no different from a normal bank account, just with a different legal ownership framework. There’s not much designed into the products to help groups to save and transact in different ways. In the case of the Joint Mortgage, another common shared financial product, the main difference is the legality of shared ownership and a higher rate of interest to mitigate any extra risk. The banking products and services offered with the mortgage product are no different.

If we regularly transact, move and discuss money in groups, why don’t the products reflect that?

Signs of innovation

What’s happening at the edges of the market? Is it changing? The good news is that some companies are starting to address this and there’s some interesting progress.

Starling bank introduced a joint account 12 months ago, where if you’re an existing customer you’re able to open a joint account without submitting any extra information – all you need is the 2 phones to be near each other, tap twice and the joint account is open. Whilst very different from the experience of having to physically visit a bank together to complete the banks standard 30min KYC set-up, the account you can open, for all intents and purposes, is the same as the current account from Starling.

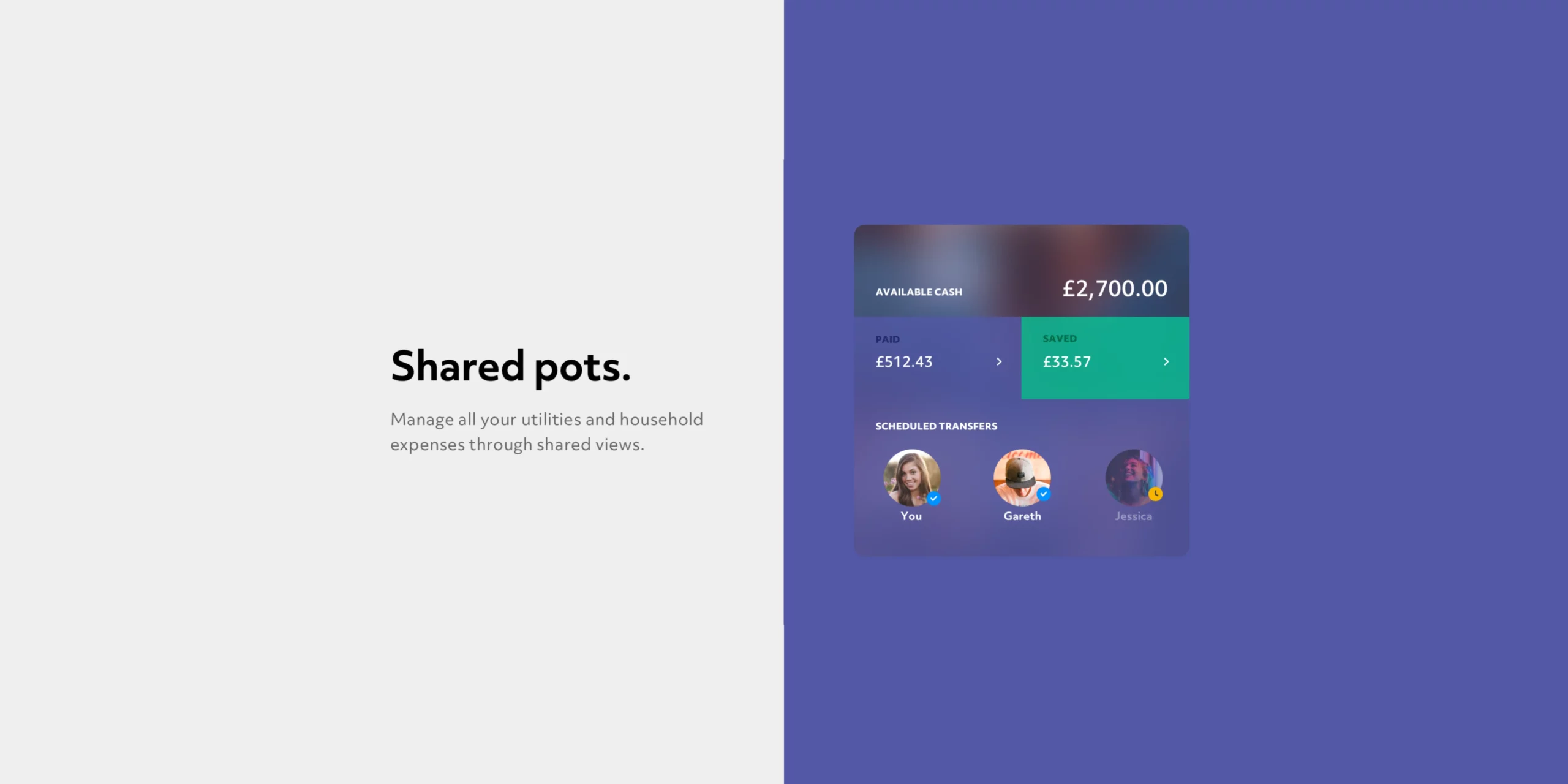

Group saving pots

Another example in the shared account space is the ‘Group Vault’ feature from Revolut. Pitched as a shared saving pot, the interesting feature is that members of the saving pot don’t have to have a joint account. The beauty of this is the ability to easily add anyone to the group (who’s a Revolut customer of course). It’s very easy to set-up and add money to it, however the downside is the withdrawals are only controlled by one person. Effectively you are giving your money over to someone else’s control. And as Revolut doesn’t have full UK banking license there’s limited consumer protection. As an innovation it’s an interesting step into shared finance, but in its current form it feels like its missing some of the basic trust elements needed to succeed. This feature will likely work well for future customer acquisition – for example members of a shared household.

These two examples have only been launched in the last 12-months, so there are signs of banks starting to cater for the world we actually live in. But what else is needed?

1. Go the extra mile with bill splitting

Bill splitting is a chore, and simple to solve, so it’s no surprise that there’s plenty of development in this space. Whilst there are some useful tools out there, most of them fall short of being ground-breaking as they appear to add in extra steps in the overall process. For customers the question becomes – is the pain of bill splitting so great that you’ll go to the bother to download and open another app to manage it, when you could just open the calculator app?

An example where there’s a significant step forward is WeChat from China. WeChat has its own payments layer integrated in the messaging platform. Arising from structural constraints within the Chinese banking system, innovation appeared around payment methods within the app, rather than being integrated from an existing bank account. With payments being an integral part of their super-platform, WeChat can offer shared bill splitting directly within a group chat (similar to how people use group messaging on WhatsApp).

Say you organise dinner on a group chat. After the meal one person can split the final bill with everyone in that chat – instantly and equally, and as easily as you would share a photo of the event. In addition, everyone in the chat can see who’s still to pay, introducing some social pressure to nudge people into paying promptly. A great idea, however it still requires a fair amount of input from the user to make sure the transactions happen, as yet nothing is automated. The interesting part is that WeChat have started to build payments directly within the messaging platform, where people directly organise their events.

From bill-splitting to shared-saving

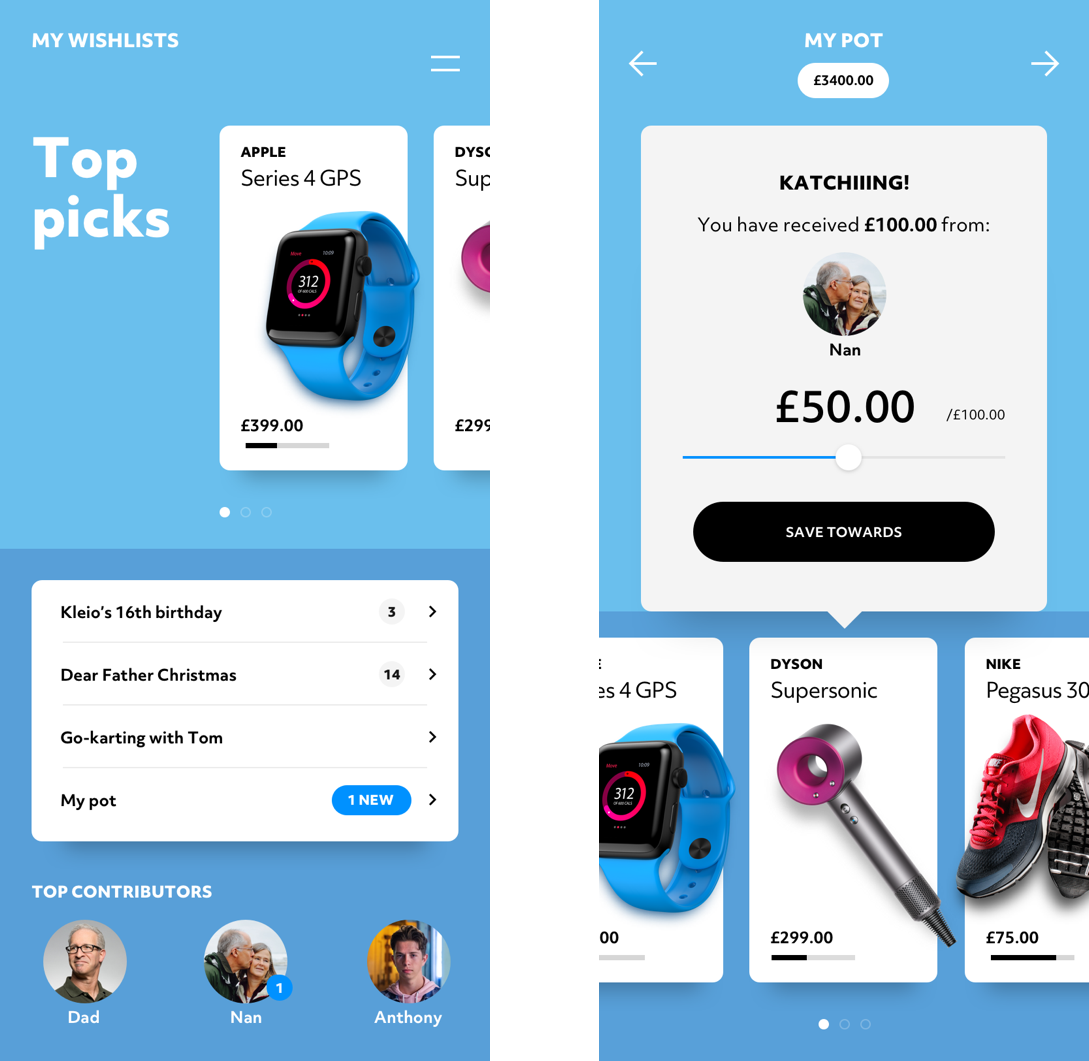

There are opportunities when looking at the flip side of bill-splitting: shared saving pots. As mentioned, Revolut has started offering some features in this space. Imagine taking it a step further and allowing people to share and control the input into a shared pot. A child saving for their birthday, would be able to share ‘the pot’ with family members. Allowing them to easily contribute to a present, and when the pot reaches its goal by integrating into a shopping partner the present arrives from Amazon already gift wrapped.

To create the next wave of bill splitting, there needs to be greater focus on bringing the transactions closer to where people communicate – whether that’s bringing the banks closer to conversations, or the other way around as shown above. And the second part is to understand what the common entry and exit points are for shared events and how other services can be neatly integrated into the overall transaction.

2. Supporting the next wave of sharing

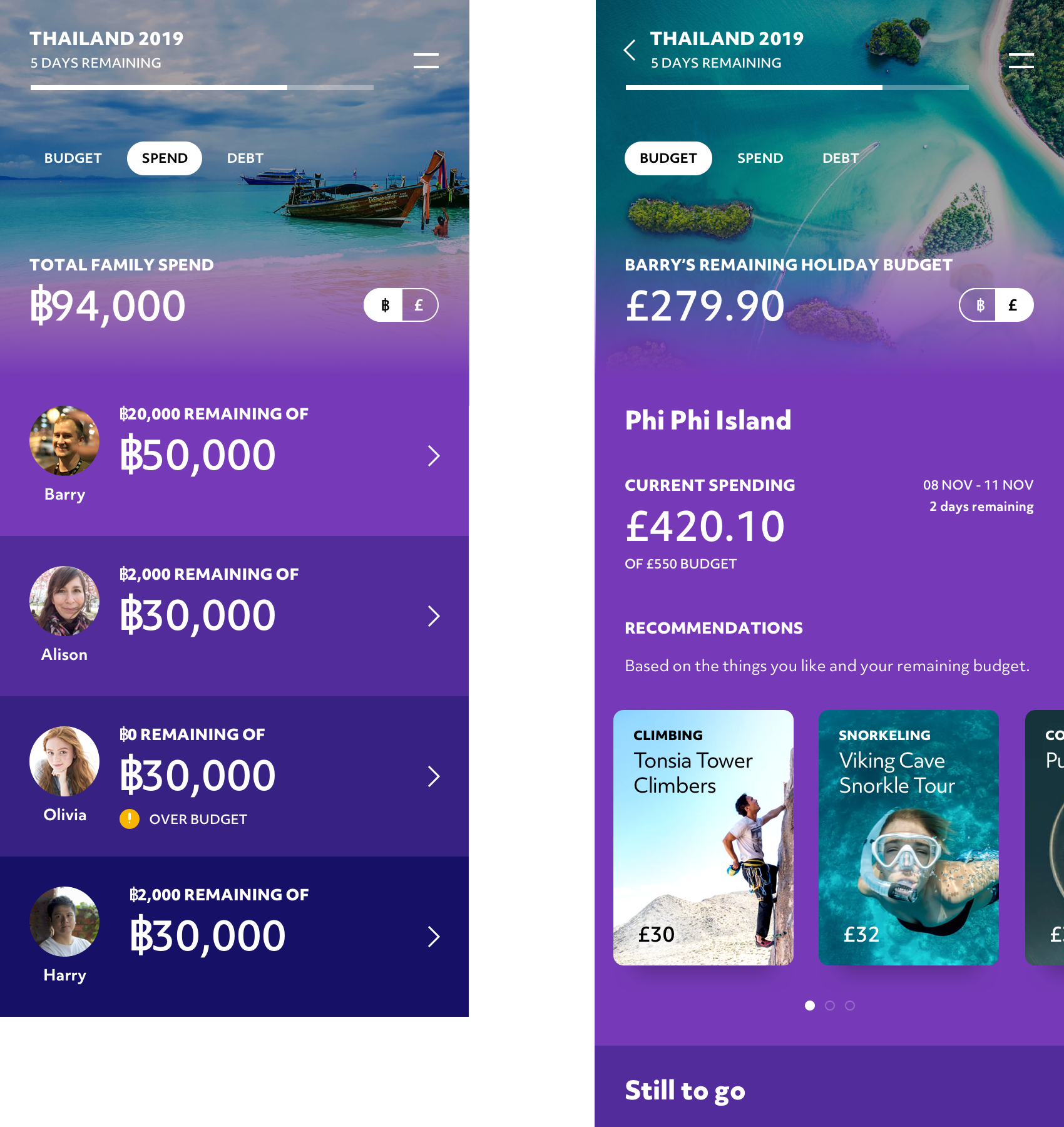

In terms of goods and services, people are sharing more than ever – a good example is to look at the more traditional field of shared living. Normally one of peoples largest outgoings, shared living can be stressful, financially. Whether it’s close friends or extended family, it seems that some people just don’t like parting with their money when the time comes.

Taking this to an extreme – what happens if you and your house mates want to buy a house together. Only a few years ago this could have been seen as an edge case, but with the rapid rise in house prices (both in the UK and globally over the last 10 years) the applications for shared mortgages are on the increase. [2% in 2018 they are projected to rise over the next 5years]

It’s clear if you’re buying a house together (outside of being a cohabiting couple) not only will you have the need for a shared mortgage but there’s a whole host of opportunities for products and services around this core product. From helping people with the basics, shared bill-splitting and saving, through to shared legal support and the complex calculations needed around flexibility and the future selling of a percentage of a mortgage. Not to mention, how do you work out who gets the biggest room – the person with the biggest deposit or the person with the largest monthly contribution?

As the trend for sharing continues, the design of solutions reflecting people’s needs is key.

3. Making modern family life that bit easier

Family finances are something that most people will have to deal with at some time in their life, whether cohabiting couples or large inter-generational families. Outside of the daily budgeting needed to keep a family afloat, there are large and complex shared financial decisions to be made – often with few tools or products available, for example: providing effective financial education for children, support for family members flying the nest or paying for senior members of the family.

The advantage of cash is that it provides a physical and tangible education of money. You can see the money in the piggy bank ‘grow’ and witness the exchange of money when swapping it for goods. With cash on the decline, how do you best educate the next generation on the fundamentals of saving and debt. Some recent Fintech examples of educational accounts, Go Henry (UK), Osper (UK), and Current (US) are moving into this space – but one of the main downsides is you have to open another account – why can’t you bolt this on automatically from your joint family account?

What a good family bank account could look like

For inspiration on what a good family bank account could look like, imagine if it was comparable to the family accounts offered by Apple, Google or Netflix. The power of their family accounts, allows you to be able to minutely control any offspring’s experience. What if we complemented that level control, with the gamification of language learning app Duo Lingo. Suddenly it’s not hard to imagine a financial product, ultimately controlled by the parents where good behaviour is learnt through tasks, nudges and encouragement. Allowing children to safely discover their world and become financially self-sufficient.

This point links with part 1 of this series; as educational needs change over time the products need to flex accordingly. A 5-year old child’s financial educational needs are very different from an 18 year stepping out in the world for the first time. Any service must be able to transition from full control into support through to becoming a safety net – initially we’re talking basic education, and later about solutions to make use of parental wealth as collateral (deposits, etc)

Looking at different types of consumers, within asian cultures it’s very common to be expected to provide support for parents or grandparents. This becomes a different type of shared family account, one that’s focused less on financial education. Family finances are more intertwined over a lifetime than they first appear, and need to be designed to support the many different ways people collectively use money.

4. Providing socially beneficial shared finance

Outside of bill splitting and family sharing, there’s already a well-developed market of peer-to-peer financial products. These came into their own after the financial crisis, when banks were forced to reduce their levels of risk exposure, creating the situation that small to medium businesses struggled to secure loans at a decent rate, and consumers found it hard to get decent returns from savings. This created an opportunity for a market place that previously didn’t exist, matched nicely by technology able to match savers and loans en masse.

And while the digital versions of peer-to-peer marketplaces generally look to scale for success, for many decades there have been smaller scale community saving and credit unions. This type of lending and saving within smaller groups, is very common and provides help to underserved consumer groups. Group and community financing like Susu’s, long practiced throughout Africa and the Caribbean, are interesting areas for innovation. (Informal Rotational Savings clubs – a cross between a loan and savings account depending on when you are holding the collective pot https://www.ft.com/content/7de2eea4-f030-11e9-bfa4-b25f11f42901)

Such small scale shared financial products are as much about community and working together as the mechanics of savings. Introducing these types of small schemes into shared finance ideas is a good way to look for innovation outside of what has been traditionally provided by the banks.

Putting people at the heart of products

The bigger point here isn’t limited to shared finance; it’s about designing products that reflect how people really transact and use money. Currently, most retail financial products are developed with consumers as secondary in the process, something that the current wave of challenger banks are working to address. Shouldn’t we be trying to fit products around people’s lives, rather than making people fit their lives around the products?

It is vital to design products that reflects real world usage, because at the end of the day it’s not only about the product, it’s about people.

Ask them. You might be surprised by what they say…

Read the 1st part of this series here

Else briefing

Don’t miss strategic thinking for change agents

One more step

Thanks for signing up to Else insight

We’ll only email you when we release an update.

Please check your email for a confirmation link to complete the sign up.

You’re all set

Ah! You’re already a friend of Else

You won’t miss any of our updates.

In the meantime, please enjoy Our Insights

Shared perspectives

Don’t miss strategic thinking for change agents

Find ideas at your fingertips with Else insight.

Here to help