Future of finance

Part 1

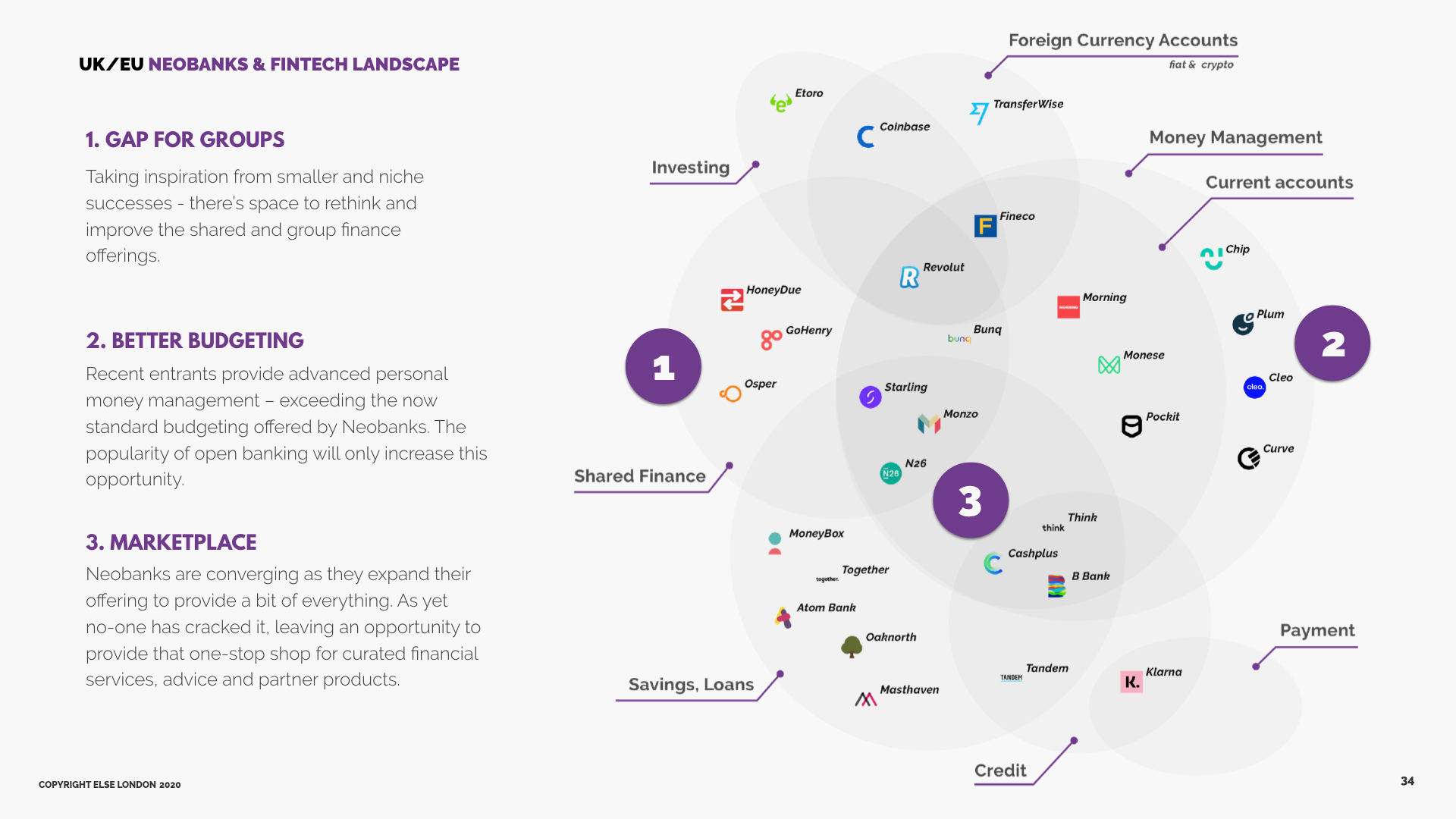

Challenger banks are here to stay. Customer adoption is clear, with a few already becoming household names, placing them firmly in the mainstream. Meanwhile, the high-street banks are catching-up and the originally distinctive offerings from the likes of Monzo, Starling and Revolut are starting to look blurred. With all of them gravitating around a common set of features, what does this mean if you plan to challenge a challenger bank today?

Loyalty in the digital age

The retail banking space is crowded and becoming ever more so. Current accounts – historically unloved by banks – have been the main focus for challenger banks. With consumer-centric thinking and slick data utilisation all built on a non-legacy technology stack, they have been able to quickly grow their customer base.

However, today it’s unclear how different the challengers actually are from each other. With a lack of distinct features on offer, they are revealing that they currently do not have defensible propositions within the marketplace. Once again it seems like every current account will soon offer the same.

Yet against this backdrop, there are some clear areas that are ripe for innovation. Throughout this series, we will look at how the ever-evolving needs of customers can shape the final product – an area where very few financial products offer the ability to flex or grow.

My financial needs today might not be the same as tomorrow

People’s financial needs are constantly evolving. From increased financial literacy through to situational curve balls, our needs are constantly in flux — even if day-to-day they feel like they barely change. At the same time the current retail banking offering is mainly static, taking a one-size-fits-all approach built on platforms that are hard, or even impossible, to evolve — meaning they are unable to dynamically adjust to the differing decisions that customers might need to make.

“Putting that into context: over the last 4 years, I got married, bought a house and had a child. Massive changes in my life, each one with big financial implications. A quick look at the different financial products I opened within that timeframe – 3 pensions, 3 joint accounts, 2 current accounts, 1 savings account, 1 trading account, applied for 2 mortgages and completely rethought my financial planning, twice – reveals the many different decisions needed to be taken.”

— Iain Cain, Lead Strategist at ELSE

And out of all of those engaged products, what have been the major changes in the last 4 years?

-

- You can now access most services direct through an app (yet, still not for all products and all of the apps behave differently.)

-

- Basic spending overviews are now becoming the norm.

However, not one of the financial products mentioned above are able to flex to match the changing needs of customers. They have all been very static and feel disconnected from one another. Working more on the principle of set and forget, rather than being able to adapt and evolve.

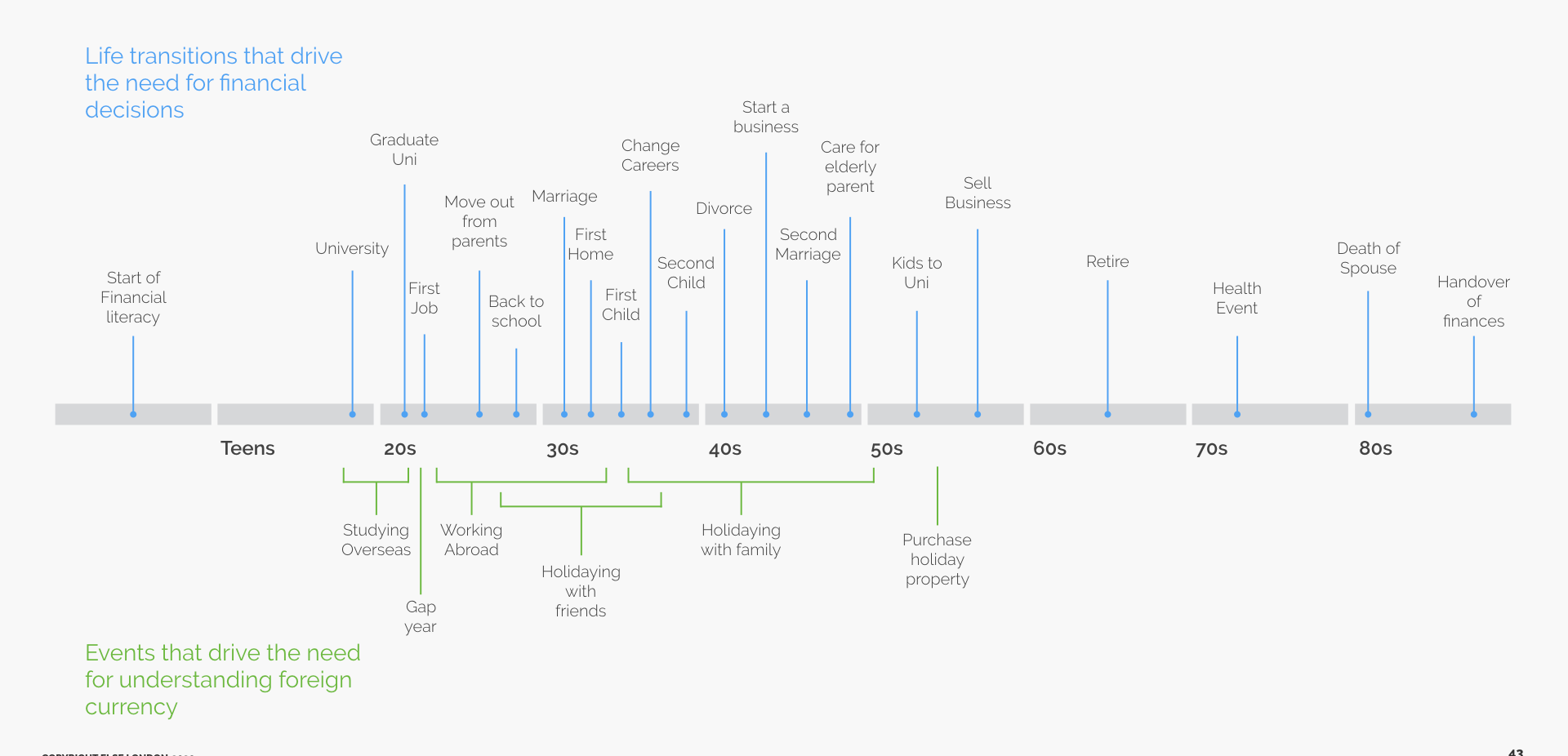

People’s financial needs change over time

Most people will encounter a number of financial events in their life, which drive the need for financial decisions. It’s clear that there’s a lot of differing decisions that people need to take, often without the expertise to do it! This highlights an opportunity to design a product that can flex or react with customers financial needs, a proposition that’s distinguished from the ongoing feature war between banks (established and new).

At the same time technology can now deliver a personalised financial experience, allowing future retail banking services to move away from the current one-size-fits-all model, and take a step towards the personal approach a local bank manager used to offer; but with a larger product offering.

Be there, when people are looking

For a long time, the true driver in retail banking has been customer inertia, which also stifled product innovation (as highlighted in the 2018 FCA Strategic Review of Retail Banking Business Models report). With most current accounts offering the same, why would a customer bother to switch to the next vanilla offering? A reluctance by banks to innovate misses the point — when people hit these financial milestones, it provides pattern interrupts that force customers to take stock, look around and see what else is on offer.

It’s a perfect time to speak to people — whether they are actively looking for support, or to understand a new financial product or solution for their current financial challenge.

At these moments customers are open to change, and banks need to use these times to target customers with laser-like accuracy, providing only the most relevant offers. By understanding the different events and mapping out which ones have the biggest disruptive effect on potential customers, there’s a chance to break the inertia. For future banking services, any customer acquisition and on-boarding strategies should be built on providing contextual and relevant offers.

Adapt with them

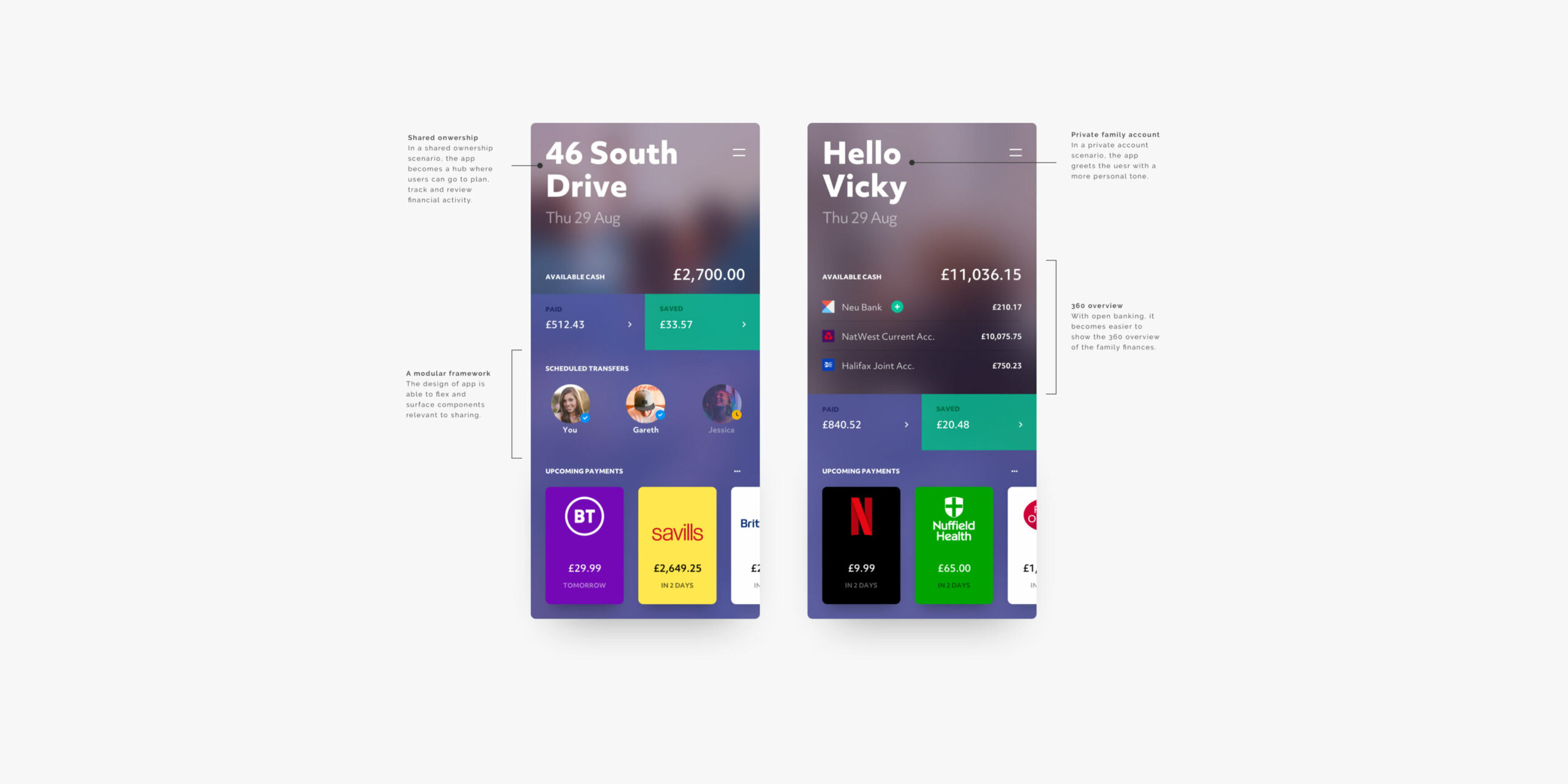

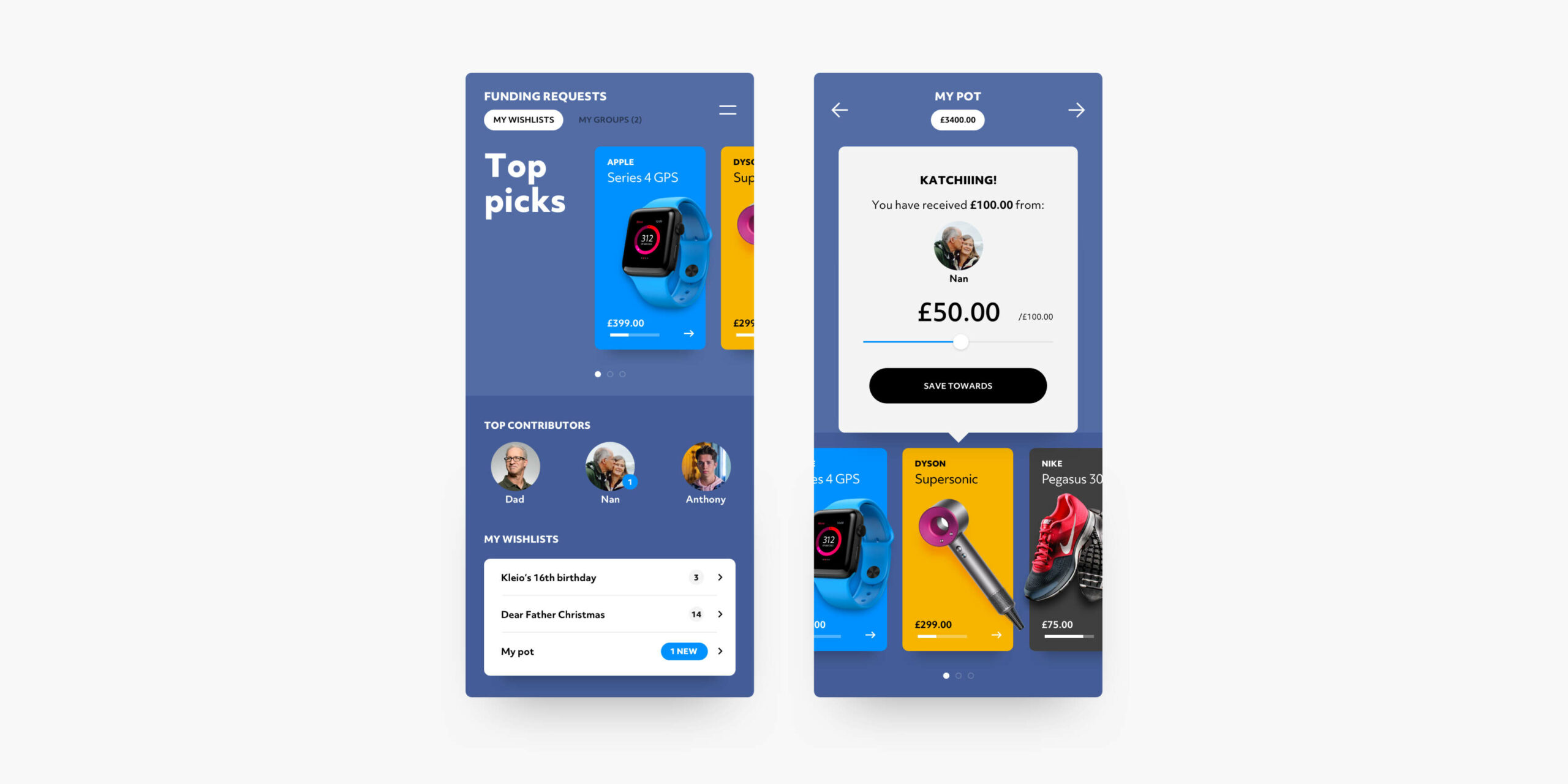

Understand that people change, their financial capabilities improve and their needs evolve over time. The most relevant features for a student about to graduate into work will be very different from a young family wanting to educate their children about money. But the core product underpinning the experience can be same – a trusted companion that adjusts seamlessly over time.

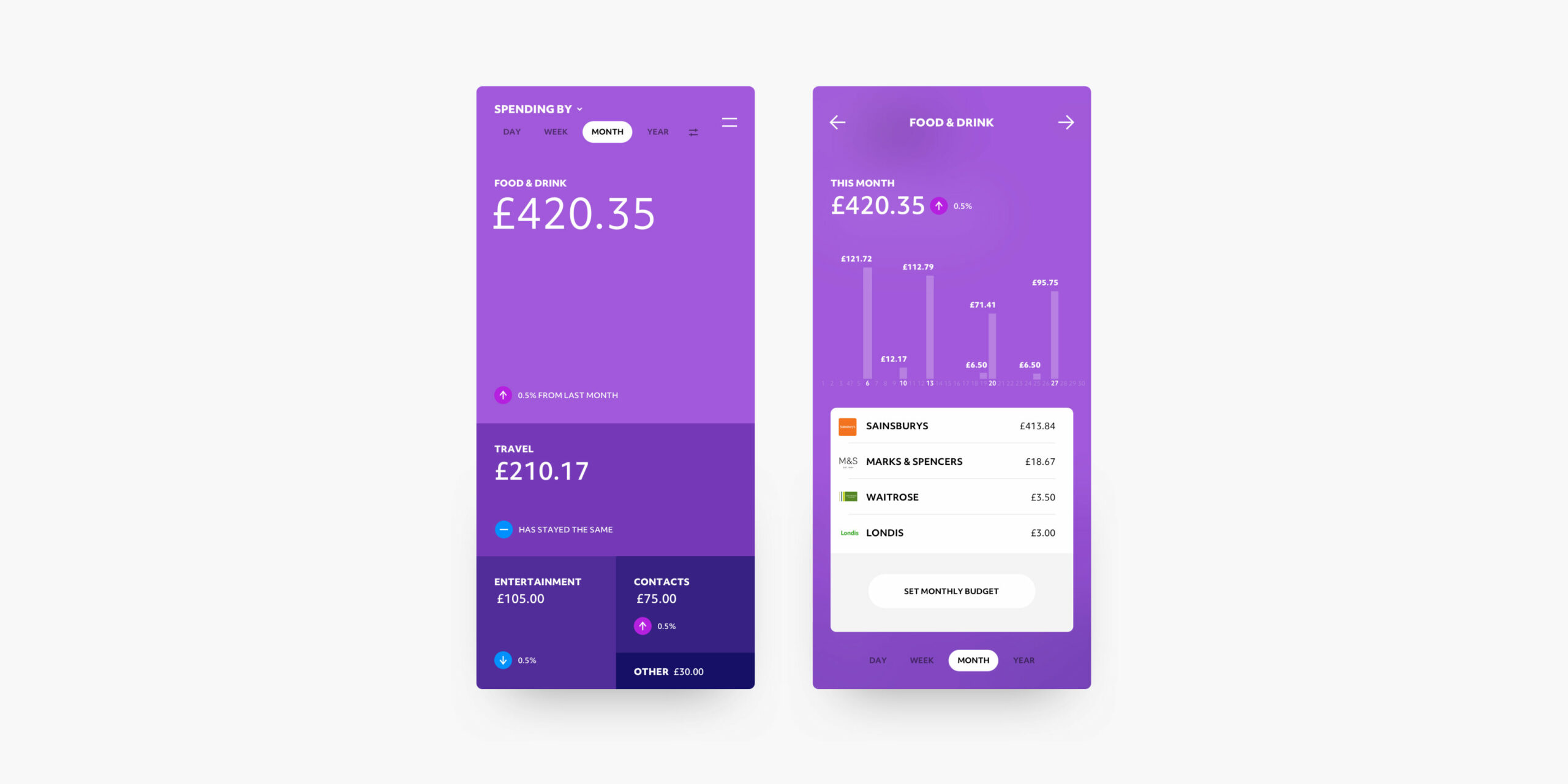

The solution? Build a modular framework to the product with a balance of fixed and flexible elements. The fixed elements reinforce the trust in the system, and the depth of the brand. Whereas the flexible elements allow for easy adaptation to changing needs – whether they be content, offers or design elements. Why can’t the interface better reflect me and my world? Do I have to view the same donut graph and chronological list of transactions as everyone else?

Either through design or through serendipity people will not follow the same paths through life – especially true for a topic as complex as finance. Any product must grow in line with our individual experiences, and not grow against the expected ‘average’ customer. Providing a service that is modular yet robust allows people to follow different product arcs but still receive the same overarching brand experience.

Put customers in control

Adaptation around the flexible elements can be proactive, using explicit or inferred information, or could be more of a customisable approach. Either way the balance of fixed and flexed elements needs to be designed to give the customer the power to decide the final outcome. Trust will always be an important consideration for banking and putting people in control at all times of their money and how it is represented is paramount.

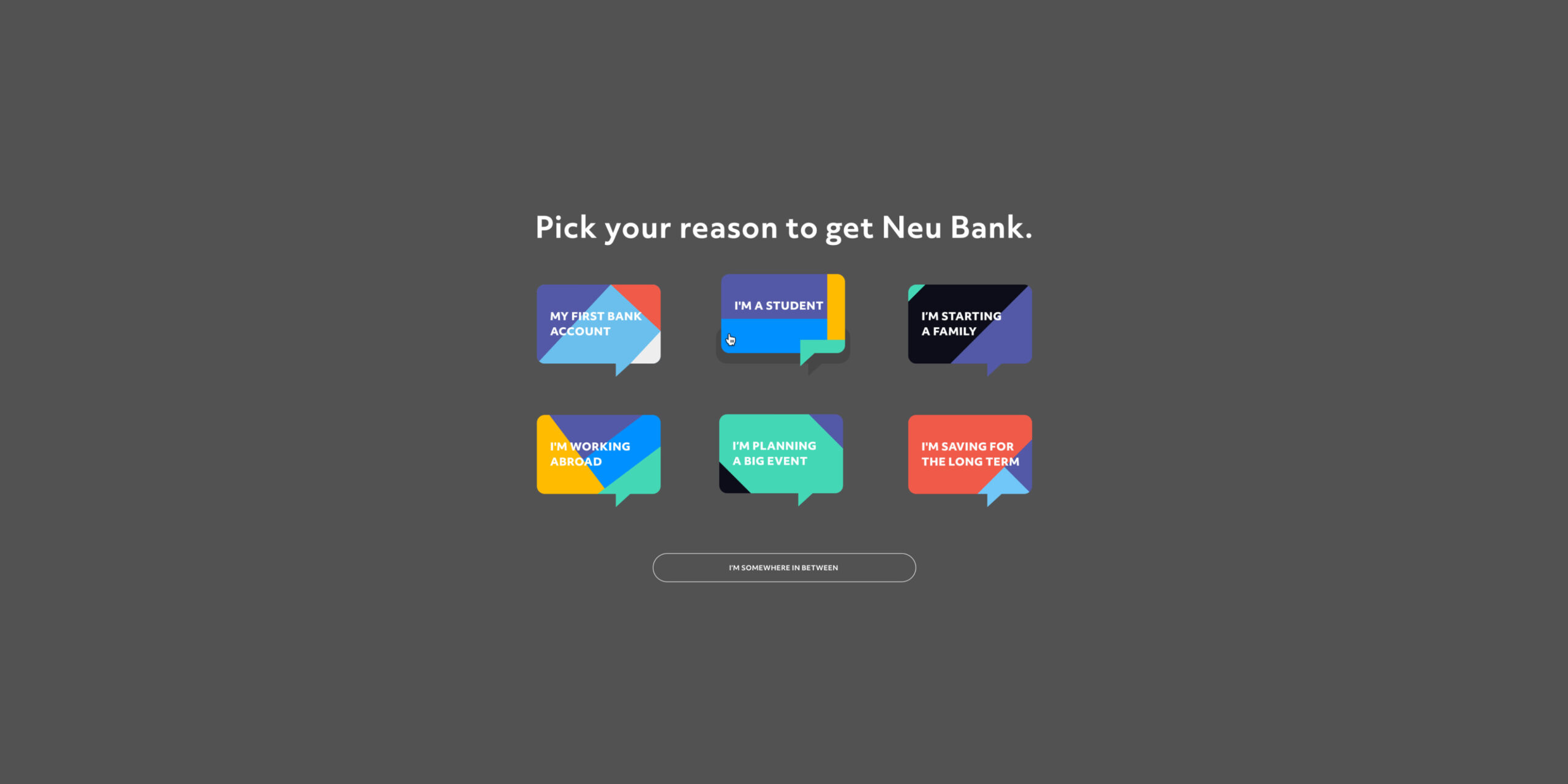

Provide the perfect start

Everyone has different reasons why they use a certain banking product, and different drivers when using it. Knowing a customer’s start point is key to successfully building a product that is relevant and can adapt over time.

Using onboarding more effectively provides us with answers to customers’ starting point, allowing a richer beginning of their banking experience to be delivered. For the family-orientated customer for example, they can be initially offered features including joint banking, life insurance offers and family financial planning tools, rather than the expat who might see foreign exchange data and extended travel insurance offers as their first options.

Knowledge-matched product design

Not only do people have different reasons for using a financial product, they also will arrive with different levels of financial capability. Offering a solution that can be used at different speeds is essential, allowing detailed tools and views for the very experienced whilst still being able to offer quick views and hand holding to the less experienced customers. People will want to use the product at different speeds throughout various transactions, perfectly matched to their financial ability.

Increasing financial literacy

The bigger goal behind this proposition becomes: what if we design a service that helps to increase people’s financial literacy? Helping people to level-up over time, the longer they use the product the greater their financial understanding becomes.

The results move any product into positive entanglement: why wouldn’t you want to stay with a service that not only understands where you are in your financial journey but also offers you support, help and relevant products on the path to financial mastery? Throughout life people will always encounter new situations that require new financial understanding: Never too old to start. Never too young to learn.

A bank that grows with you

It’s not enough to offer an app, card freezing and a premium metal card. These are the table stakes for entry. To leapfrog the competition and stand out, you’ll have to do things differently.

People’s lives evolve, their financial needs evolve and most people not only struggle with the big financial decisions but underestimate the financial cost of not taking a decision (compound interest, anyone?). Yet the products that we use everyday, and the next wave of products, aren’t yet designed to match the changing needs of people.

Offering solutions that aren’t one-size-fits-all is a step towards this. And going a step further for the future of retail banking, is it even enough to stand out from the crowd by saying “We will offer financial products that grow with you”?

Perhaps a better starting point is to say, “We’re going to offer financial products that help you grow”.

Else briefing

Don’t miss strategic thinking for change agents

One more step

Thanks for signing up to Else insight

We’ll only email you when we release an update.

Please check your email for a confirmation link to complete the sign up.

You’re all set

Ah! You’re already a friend of Else

You won’t miss any of our updates.

In the meantime, please enjoy Our Insights

Shared perspectives

Don’t miss strategic thinking for change agents

Find ideas at your fingertips with Else insight.

Here to help